Soaring beyond borders

Bridging innovation

What sort of role can Hong Kong play in this megatrend? Lawrence Iu Chun-yip, executive director of Civic Exchange, would like to see the city position itself as an "agent and middleman" to bridge mainland technological applications with those of the world, given the discrepancy in aviation standards.

The HKSAR could help mainland companies engaged in the low-altitude economy to get international approval for linking the standards required, which could help the sector tap the global market.

"The HKSAR government has been very active in bridging mainland technology with the world," says Iu. "We definitely have to think about how to use the low-altitude economy to make Hong Kong a hub for innovation, and work with cities in the Guangdong-Hong Kong-Macao Greater Bay Area to fulfill our role."

Lam stresses the importance of the city's common law system - a legal foundation that contributes to its role as a "superconnector" by linking the mainland with the global community.

Lam's company, X Social, has helped the mainland's drone businesses expand to some 20 countries, including those in Southeast Asia and the Middle East. He says many contracting parties tend to clinch deals in Hong Kong as businesses see legal issues as a major concern in other jurisdictions.

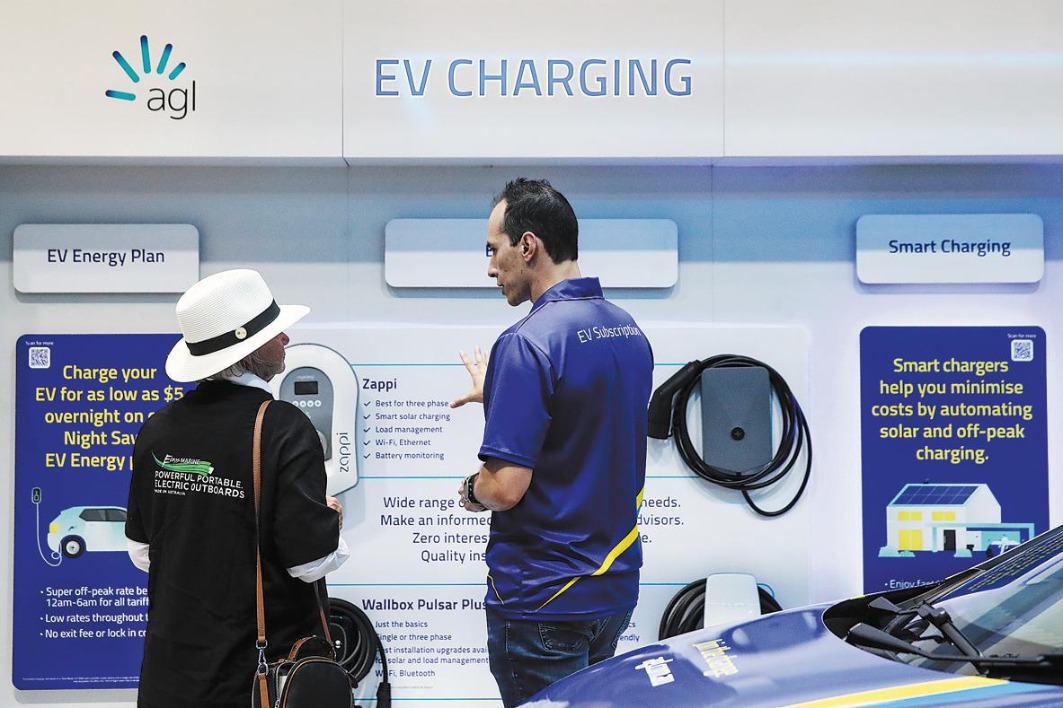

Another telling example is Volar Air Mobility. The startup is stepping up efforts to help an electric aircraft model developed by a mainland State-owned partner become commercially successful globally. Ex-banker Hooi highlights the green aviation funding potential enabled by carbon credit offset mechanisms, which play into Hong Kong's strength as an international financial and green center.

According to co-founder Koh, Volar seeks to tap the Southeast Asian economies as the first step, followed by the Middle East, Europe and Africa.

Hong Kong's strengths in green finance are also an asset. As a leading green finance center, developing the low-altitude economy can maximize the city's traditional and innovative green financing channels to help companies raise capital at relatively low interest rates, says Ip.

While established firms may benefit from traditional green bonds and loans, early-stage or unproven companies in this sector often face challenges accessing such products due to perceived higher risks. To close the gap, innovative green financing channels, such as sustainability-linked bonds with specific low-altitude economy metrics, venture capital, and government-backed funds that focus on green investments, can be utilized.