China's efforts reinforce confidence of investors

Confidence: China plays key role in innovations

As the global investment community grapples with the erratic policies of the United States, China's consistent approach to policymaking, coupled with its thriving technological innovation ecosystem, is emerging as a beacon of stability, drawing renewed interest from foreign investors, said economists.

Robin Xing, chief China economist at US investment bank Morgan Stanley, said the overall market sentiment, both at home and abroad, is optimistic toward China's policy package introduced earlier this month during the two sessions — the annual meetings of the nation's top legislative and political advisory bodies.

"While the policy support unveiled during China's two sessions might not have been as aggressive as some had hoped for, the overall direction and substance of the measures are well within the realm of what the market had anticipated," Xing said.

Benjamin Lam, deputy president of MUFG Bank (China), a subsidiary of Japanese global financial services group Mitsubishi UFJ Financial Group, said that after strategically reviewing their businesses in China, more multinational corporations are reaffirming their commitment to developing and continuing business in the country.

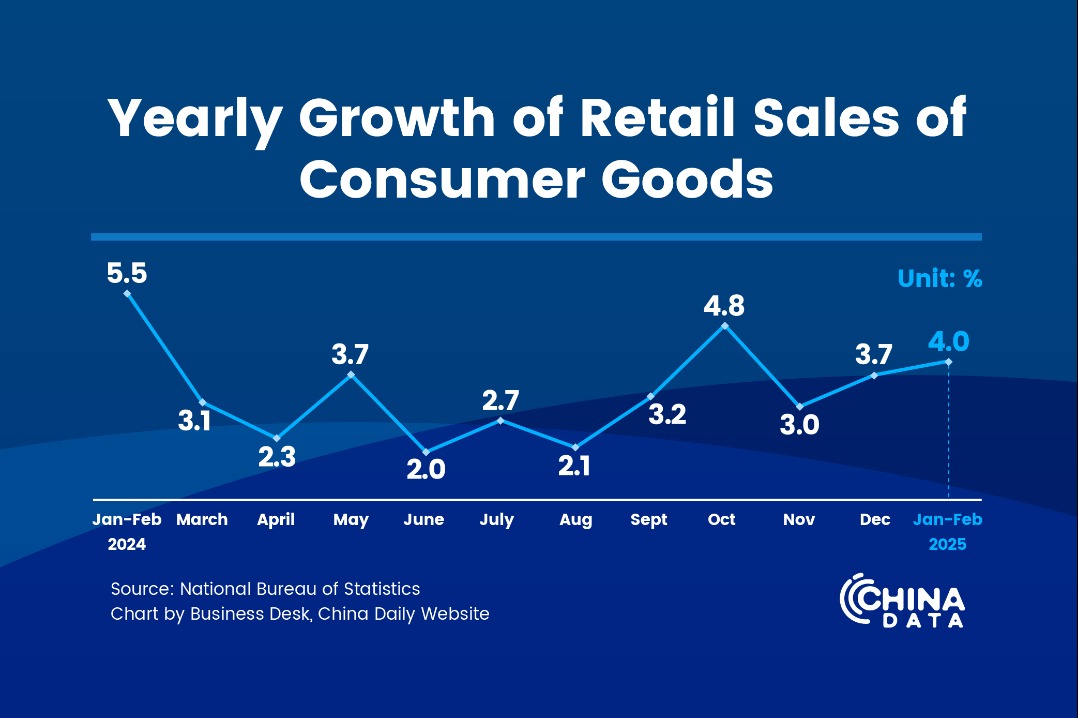

Noting that "the Chinese economy is improving and growing at a much better pace", Lam said the Chinese government's consistent efforts to revive consumer spending, including an action plan unveiled over the weekend to boost consumption, are reinforcing investors' confidence.

Meanwhile, a different story has been unfolding on the other side of the Pacific Ocean. The Economic Policy Uncertainty Index for the United States — devised by researchers from Northwestern University, Stanford University and Chicago University — surged to an unprecedented level in February, reflecting the confusion and apprehension among consumers, investors and businesses.

"Weeks into his presidency, US President Donald Trump has unleashed a barrage of tariffs and tariff threats targeting friends and foes," said Stefan Angrick, a senior economist at Moody's Analytics, adding that the trade war is no longer a risk, but a reality.

"Markets are rattled. Business sentiment surveys show confidence plunging. Equities are struggling. Consumer confidence is eroding. And the US retail sales and employment conditions have worsened meaningfully in the past month or two," he said.

Earlier this month, Goldman Sachs revised downward its 2025 GDP growth forecast for the US from 2.4 percent to 1.7 percent, citing worsening trade policy expectations. Morgan Stanley also lowered its forecast for the US from 1.9 percent to 1.5 percent, citing weak economic data and tariff concerns.

Xing, from Morgan Stanley, said, "When we look at the global market dynamics, it's evident that the US market is wrestling with heightened levels of uncertainty, while the Chinese market is showing signs of stabilization and recovery."

The divergence of market sentiment in the world's two largest economies is creating a stark contrast that is shaping the perception of investors and businesses, he said.

"Over the past two months, we've seen various investment banks revise their assessments of the Chinese market upward," he added.

Goldman Sachs has revised its 12-month target for the MSCI China Index upward by 13 percent to 85. This includes shares listed onshore and overseas. The investment banking and securities firm has also raised the CSI 300 Index of the largest yuan-denominated Chinese stocks by 2.2 percent to 4,700.

Xing highlighted the "reignited confidence of entrepreneurs and the rising enthusiasm in the sci-tech sector", as the recent fanfare surrounding the "Six Little Dragons" — a group of Chinese tech startups based in Hangzhou, Zhejiang province, spearhead by DeepSeek and Unitree Robotics — has challenged the long-held perception about China's innovation potential.

Deutsche Bank hailed DeepSeek's rise as China's "Sputnik moment", drawing a parallel with the then Soviet Union's launch of the world's first man-made satellite in 1957, which caught the West by surprise.

Xing said that over the past three years, the general narrative was that the US is the sole superpower in the realm of technological innovation, particularly in emerging fields such as artificial intelligence. The current realization is that the world has returned to its multipolar order, in which innovation is not the forte of the US alone and sees remarkable contributions from Asia, particularly China, he added.

Ole Gerdau, chief operating officer at Deutsche Bank China, said the realization has sounded a wake-up call for the world that now is the time to invest in China. "We expect this year to be the turning point where international investors are going to shift their focus and make a higher allocation in the Chinese market," he said.

Looking ahead, Kenny Pan, Asia-Pacific vice-president of Huntsman Polyurethanes, said that China's ability to drive innovation in breakthrough technologies in the coming years cannot be underestimated.

With increasing policy support and investment in research and development, AI technologies will improve efficiency and promote innovation across various industries and application fields, Pan added.

Xing, from Morgan Stanley, said that as Chinese companies have demonstrated a strong aptitude for taking technologies that are "good enough" and successfully deploying them in actual market settings, this late-mover advantage is emerging as a significant factor influencing the overall market sentiment.

He emphasized the need for China's policymakers to further strengthen policy support for debt restructuring, boosting consumption stimulus and bolstering business confidence, thereby creating a more broad-based recovery to draw global investors in the long run.