Tapping potential of growth

With the demographic dividend declining, further reforms are necessary to release vitality to sustain development

Over the past three decades, China's economy saw an average annual growth rate of almost 10 percent. There are many reasons for the rapid growth, but a major one was the country's favorable demographic structure.

The working-age population, those between 15 and 59, was on the rise, while the population dependency ratio, the ratio of the non-working population to the working population, was falling. The abundance of labor offset many negative elements such as the marginal effects of investment and provided ample support for robust economic growth.

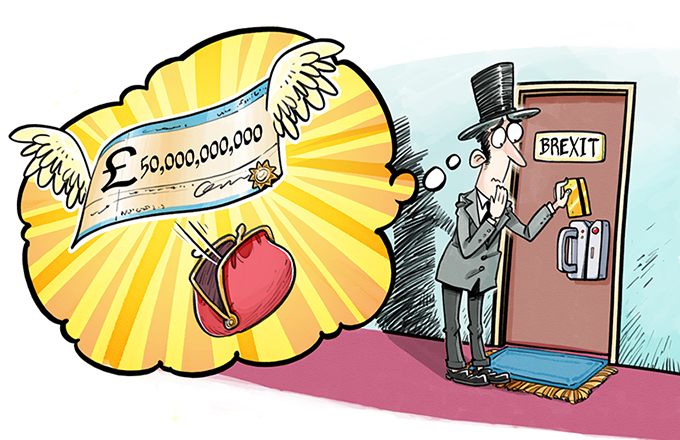

Cartoon / Luo Jie

However, the working-age population could not grow forever. China's working age population peaked in 2010 and the population dependency ratio began to show a rising trend.

As a result, the demographic dividend started to diminish, too, and this has partly caused a slowdown in China's economic growth, which fell to 7.7 percent last year and 7.5 percent for the first seven months of this year.

Accepting the fact that the country's demographic dividend is dwindling does not mean we should stand idly by. China needs to find new engines to support its economic growth, which is key to realizing the Chinese Dream for a better living.

Premier Li Keqiang has vowed to reap new dividends through further reforms. But there are still many systemic obstacles that prevent the factors of production from fully realizing their potential, if these can be removed China can expect to gain huge dividends.

For example, it is estimated that if labor productivity rose by 1 percent economic growth would rise by almost 1 percent. Therefore, the dividends derived from reforms, if properly exploited, could well make up for the loss of the demographic dividend. Moreover, the reform dividends do not rely on cheap labor, which will make China's economic growth more balanced and sustainable.